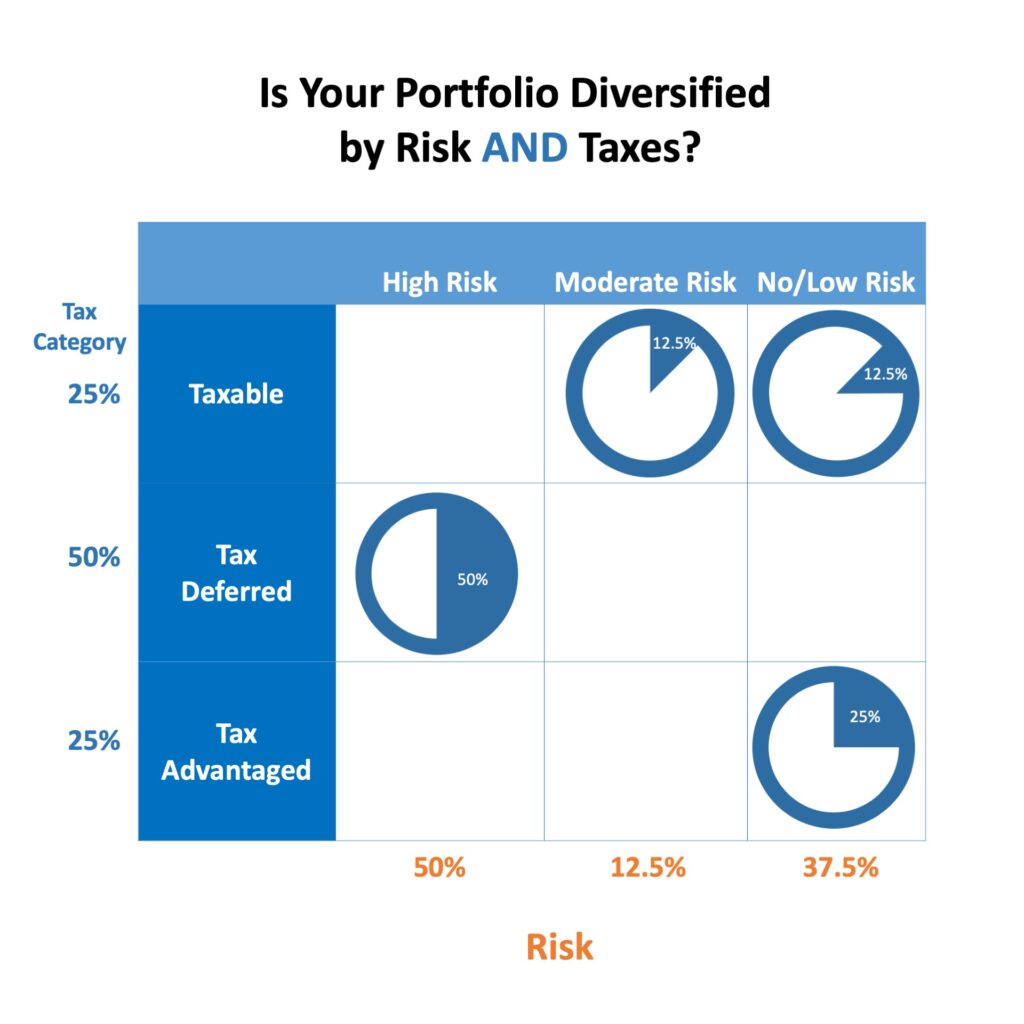

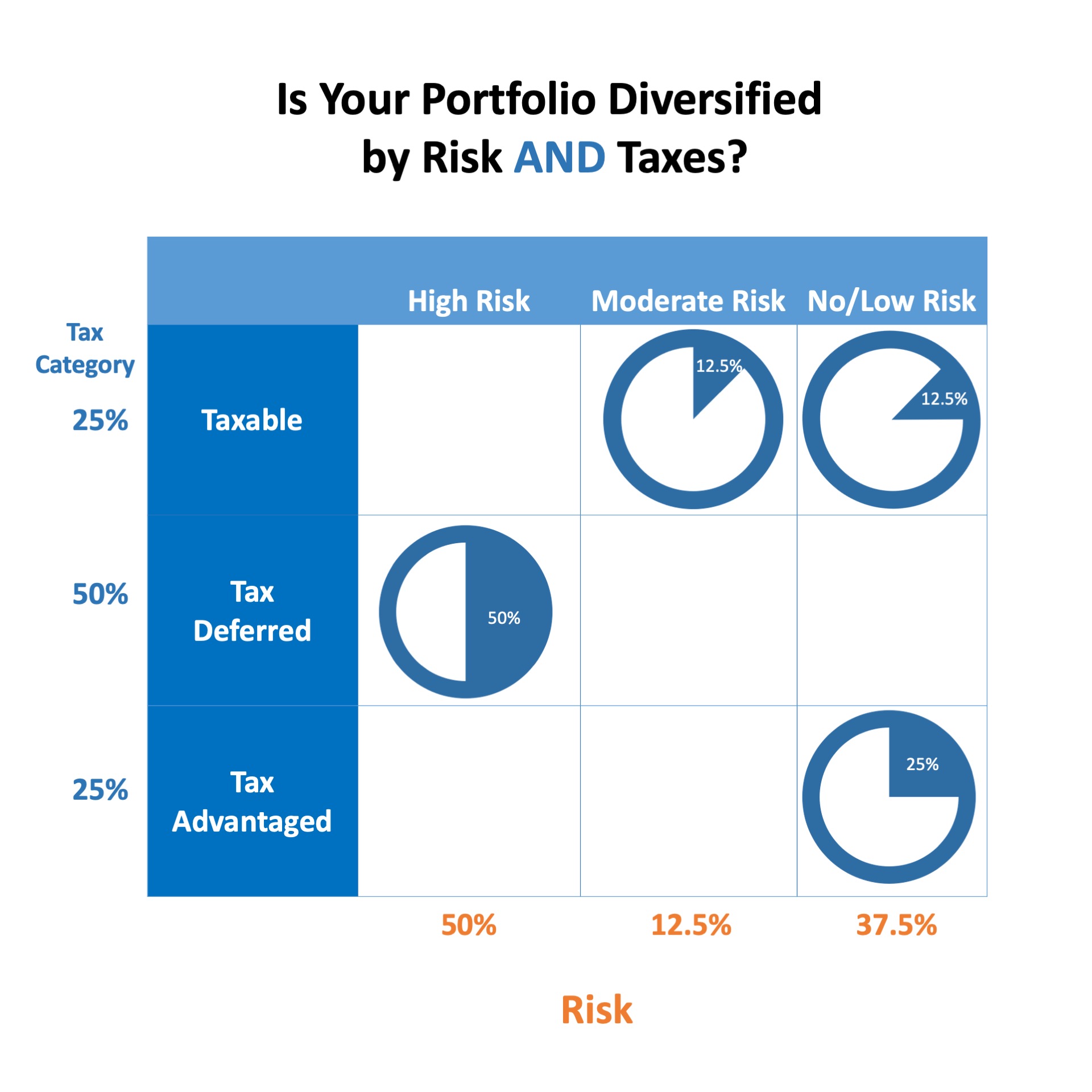

We know the importance of diversifying our portfolio in terms of risk. The younger we are, the more risk we can afford. As we get older, we have less years to weather a recovery, so we need to diversify more towards low risk vehicles.

But did you know that it’s important to diversify your portfolio from a tax perspective? Most of my clients’ portfolios are in their IRA/401Ks, which is tax deferred, not tax free. Stock sand mutual funds that aren’t part of a retirement plan are considered taxable. So are bank savings accounts. There are tax free and no/low risk options..they do exist. Try this exercise on your own portfolio and see how balanced you are from taxes and risk.

Recent Comments