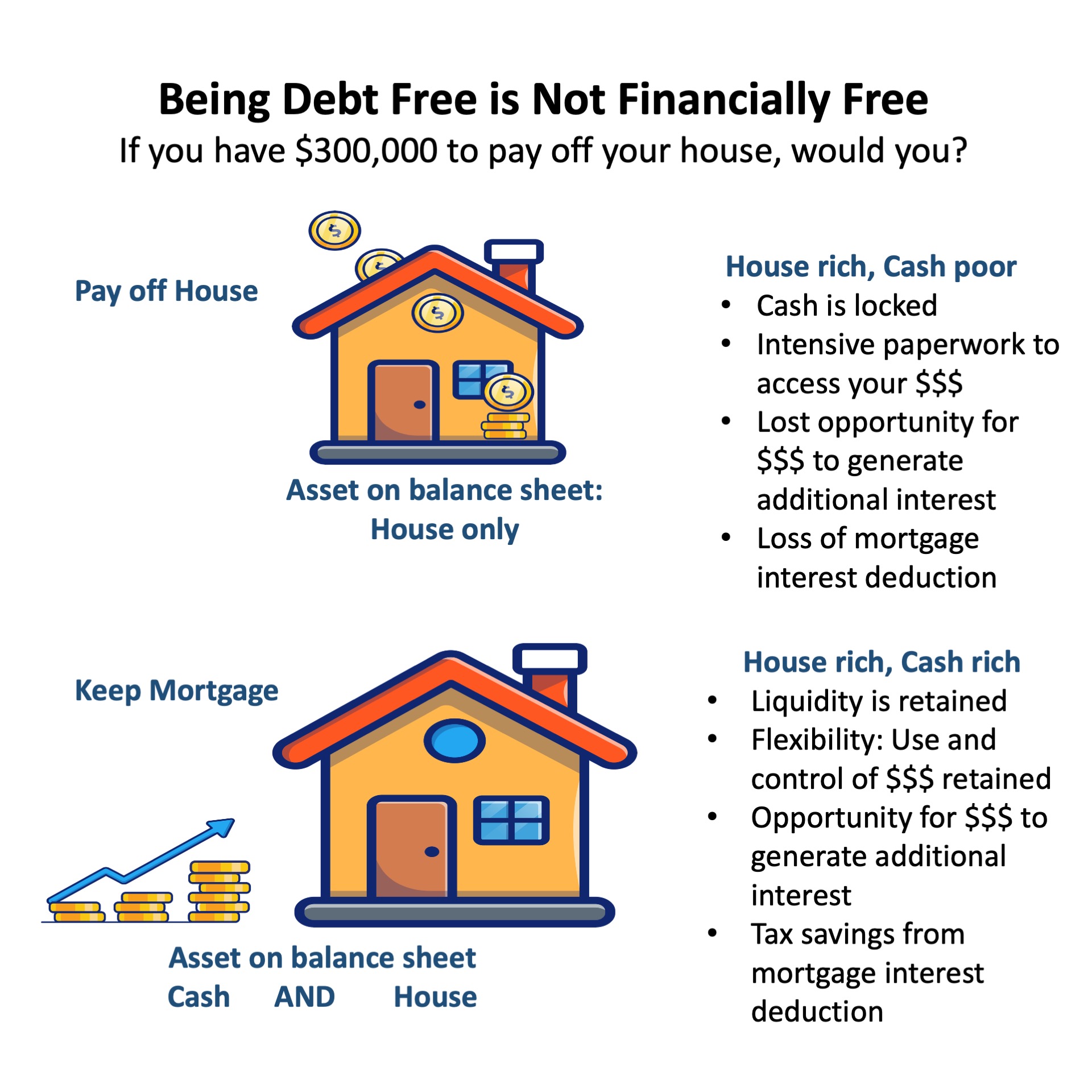

If you have $300,000 to pay off your house, would you?

Being debt free is not the same as being financially free. An example of that is by paying off your house. Yes, you don’t have any payments, but you also don’t have liquidity, flexibility, interest generating opportunity, and tax deductions. And trying to tap into your money once it’s sunk in the house requires a lengthy process of income and asset verification –on money you willingly sunk into the home. With a mortgage, you may have payments, but you also have more options.

If you pay off your house, the asset on your balance sheet is only the house. Your are house rich, but cash poor. Other disadvantages:

- Your cash is locked in the house.

- Yes, you can apply for a home equity line of credit (HELOC), but the paperwork to access the funds involves a long process, not to mention the paperwork needed.

- You lose the opportunity to generate additional interest with the cash you would have had

- You lose the mortgage interest deduction.

If you have a mortgage, you have two assets on your balance sheet, the house and cash. You are house rich AND cash rich.

- Your liquidity is retained

- You get flexibility to use and control your $$$ the way you see fit.

- You get opportunity for cash to generate additional interest.

- You get tax savings from the mortgage interest deduction.