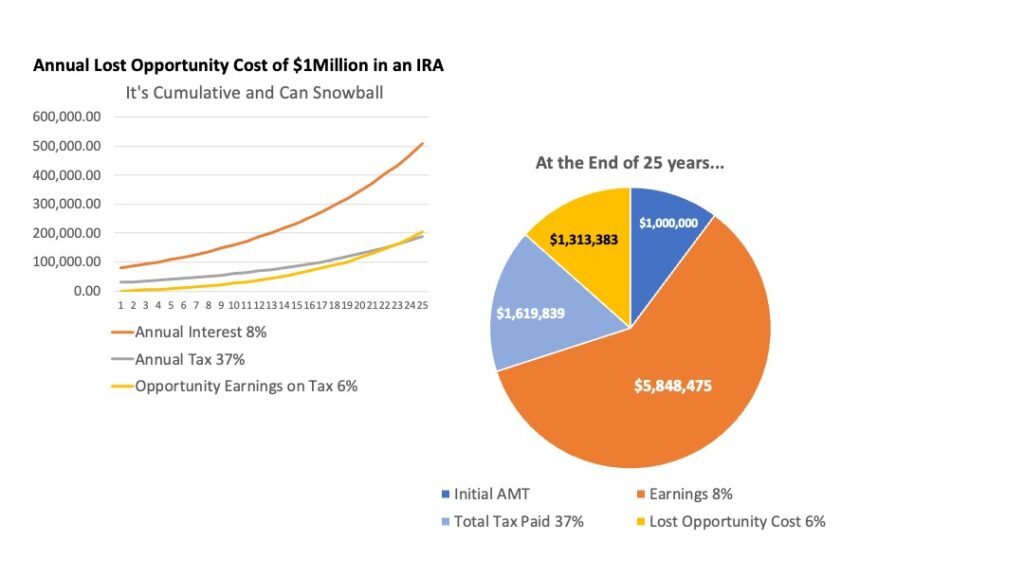

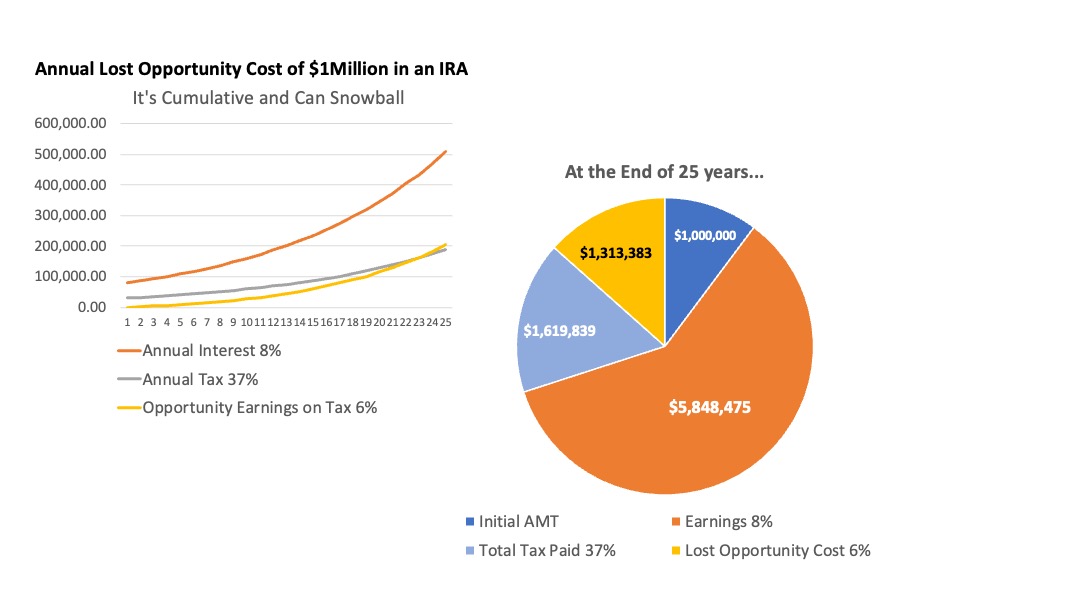

With Secure ACT 2.0 pushing out the age for required retirement account withdrawals from 70 1/2 to 73 (or 75), many retirees will opt to “let it ride” and delay taking funds out of their IRA, 401ks, 403bs, or SEPPs. But did you know that when you delay taking a withdrawal, not only does your tax obligation grow, but also the lost opportunity cost of paying the tax early, and redirecting the proceeds into a tax advantaged account? Redirecting the funds earlier could mean keeping more of your hard earned money.

Take this example of a $1M balance of an IRA fund. After 25 years earning 8%, there will be $1.6M of tax (37% rate) due. If there was no withdrawal, not only are there taxes, but also $1.3M of lost opportunity cost by not taking action. Also because the lost opportunity cost is cumulative, in later years annual lost opportunity cost can even surpass the annual tax.

The above example is extreme, but intended to highlight a hidden cost in the funds that many of us rely on for retirement. The longer the delay, the bigger the tax obligation, and the bigger the lost opportunity cost. As always please consult with your tax advisor when making decisions that can have huge financial impact.

Recent Comments